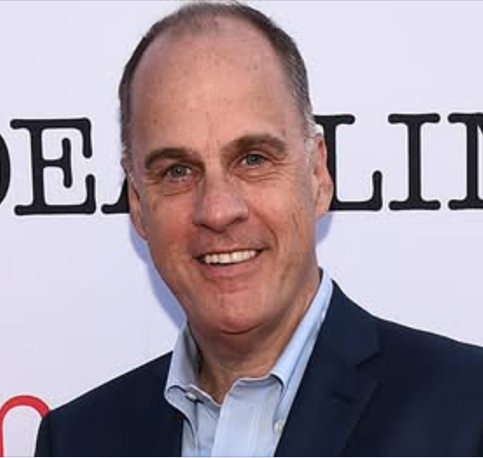

Theodore Farnsworth, 62, from Miami, entered a guilty plea in the Southern District of Florida for defrauding investors in two publicly traded firms, Helios & Matheson Analytics Inc. (HMNY) and Vinco Ventures Inc. Farnsworth confessed to running fraudulent schemes between 2017 and 2024, where he artificially boosted stock prices by disseminating false and misleading information about the companies’ activities, causing substantial financial losses for investors.

From August 2017 to March 2019, while serving as HMNY’s chairman and CEO, Farnsworth misled investors about MoviePass, the subscription-based movie ticket service owned by HMNY. He falsely promoted MoviePass’ “unlimited” plan, claiming it was sustainable and would break even, when in reality, the plan was a money-losing marketing gimmick aimed at attracting new subscribers and artificially inflating HMNY’s stock price. Farnsworth also misrepresented the company’s use of advanced technologies, like artificial intelligence and big data, to monetize subscriber data—claims that were entirely false.

Farnsworth’s deceitful behavior didn’t stop with his activities at HMNY; he carried on his fraudulent schemes at Vinco Ventures from 2020 to 2024, where he had a brief stint as CEO. Alongside his accomplices, he obscured the reality of Vinco’s financial situation, misleading investors and artificially boosting the company’s stock price.

His fraudulent tactics also involved instructing MoviePass employees to “throttle” subscribers who overused the service, a move aimed at curbing cash outflows and disguising the company’s financial troubles.

Lowe admitted to securities fraud last September, and according to court documents, his sentencing is set for March. He could potentially face up to five years behind bars.

Lowe’s lawyers Margot Moss and David Oscar Markus expressed in a statement “ he is a good man who is looking to move forward with his life.” They continued, “He has accepted responsibility for his actions in this case and will continue to try to make things right.”

In 2017, MoviePass created a sensation in Hollywood with an enticing offer: for just about $10, subscribers could watch one movie each day for an entire month. This promotion led to a rapid surge in popularity, amassing 3 million subscribers in under a year. However, the underlying business model was fundamentally flawed, leading to significant financial losses, and the company ultimately ceased operations two years after its explosive debut.

After ceasing operations in 2019 and entering bankruptcy in 2020, MoviePass was set to make a comeback, as reported by CNN. This revival follows co-founder Stacy Spikes’ acquisition of the company out of bankruptcy in 2021. Spikes, who was instrumental in founding MoviePass, was ousted in 2018 after the company was sold to HMNY. In a presentation held in New York, he revealed plans for the relaunch and acknowledged the significant losses and trust issues faced by many when MoviePass collapsed, as noted by Variety.

In 2022, former cofounder Stacy Spikes announced plans for a relaunch, but the revamped service no longer provides unlimited access to movie theaters.

Farnsworth has pleaded guilty to one count of securities fraud and one count of conspiracy to commit securities fraud. He could face up to 20 years in prison for the securities fraud charge, plus an additional five years for conspiracy. A sentencing hearing will be set for a later date. The case, investigated by the FBI New York Field Office, is one of the first to involve charges of “AI washing,” where companies falsely claim to use advanced technologies to mislead investors. Principal Deputy Assistant Attorney General Brent S. Wible emphasized that the Justice Department is committed to protecting investors from such fraudulent schemes.

“This case underscores the critical need for transparency and honesty in the financial markets,” said Wible. “We will continue to hold those who seek to deceive investors accountable for their actions.”